Markets

Florida

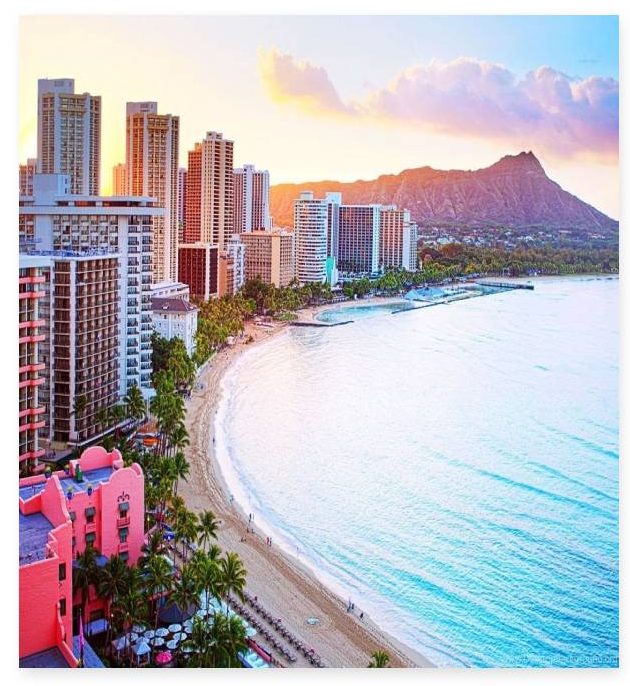

Hawaii

Favorable Rental Market: A steady flow of tourists creates a high demand for short-term vacation rentals. Additionally, the presence of military personnel and university students creates a stable demand for long-term rentals.

Limited Land Supply: Hawaii’s land is limited due to its island geography, which creates scarcity in real estate properties. This limited supply can contribute to long-term appreciation of property values, making it a potential hedge against inflation.

International Appeal: Helps to broaden the pool of potential renters or buyers.

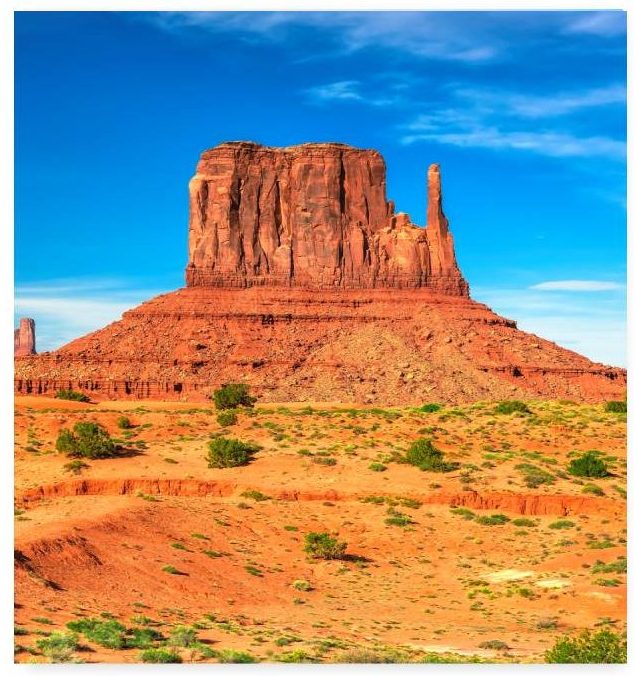

Arizona

Retiree & Snow Bird Magnet: Arizona’s warm climate and affordable living costs make it a popular destination for retirees and snowbirds, driving demand for housing accommodations year-round.

High consistent demand: Demand in Arizona extends to various types of properties, from single-family homes to long-term rentals, and short-term, and mid-term rentals. This diversity, driven by population growth, allows us to diversify our portfolio with multiple exit strategies.

Land Availability: Arizona still has available land for development, leading to development growth, especially in the suburban areas.

Texas